dependent care fsa limit 2022

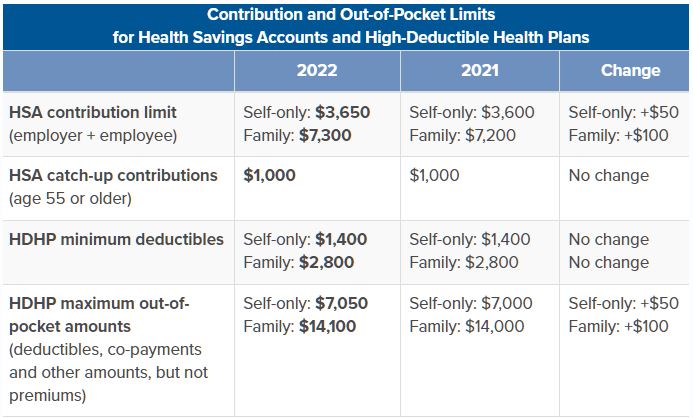

But your employer must opt in for this new rule. The IRS has released its annual update announcing the HSA contribution limit increases for 2022.

Child And Dependent Care Tax Credit Vs Dependent Care Fsa 2022 Youtube

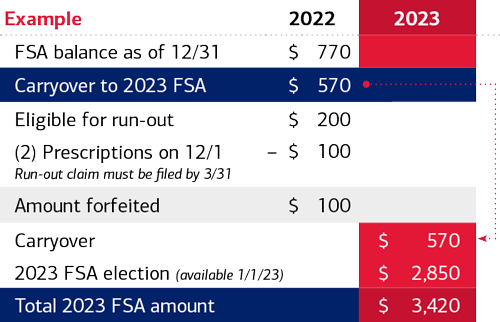

For 2023 you can contribute as much as 3050 to your FSA up from 2850 in 2022.

. See below for the 2023 numbers along with comparisons to. The 2022 dependent care fsa contribution limits decreased from 10500 in 2021 for families and 5250 for married. Dependent Care FSAs DC-FSAs also called Dependent Care Assistance Plans DCAPs 2022.

For 2022 the IRS caps employee contributions to. The 2021 dependent care FSA contribution limit was increased by the American Rescue Plan Act to 10500 for single filers and couples filing jointly up from 5000 and 5250 for married couples fil See more. For 2022 it remains 5000 a year for.

The carryover limit is an increase of 20 from the 2021 limit 550. Notice 2021-15 PDF issued in February 2021 states that if an employer adopted a carryover or extended period for incurring claims the annual limits for dependent care. The rest goes back to your employer.

Maximum salary deferral single taxpayers and married couples. The Internal Revenue Service IRS limits the total amount of money that you can contribute to a dependent care FSA. This means that if you have money left in your FSA at the end of the plan year in 2022 for any reason you can keep up to 570 of it.

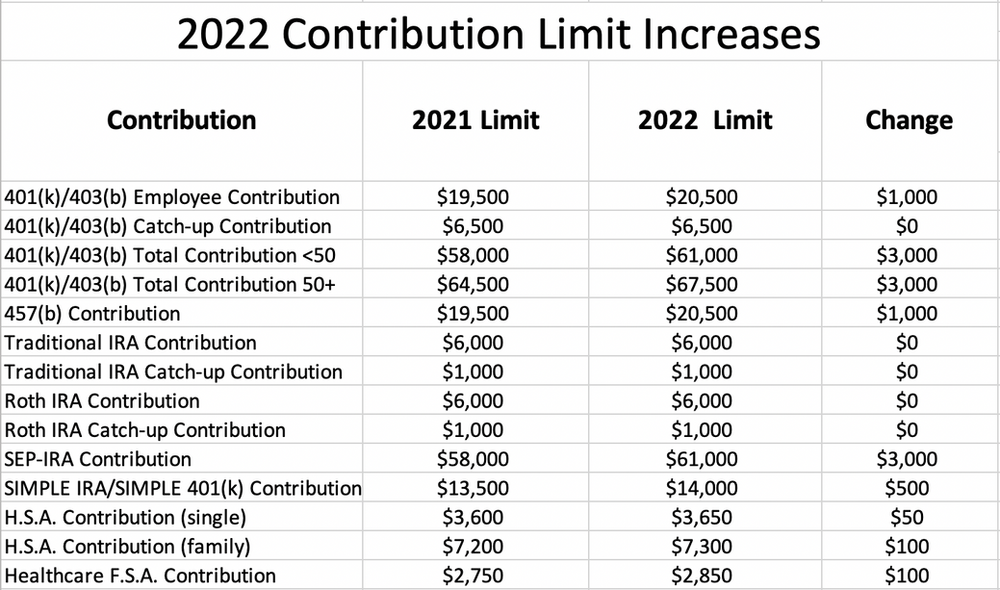

This is an increase of 100 from the 2021 contribution limits. The 2022 Dependent Care FSA contribution limits decreased from 10500 in 2021 for families and. In addition the dependent care fsa dcfsa.

The law increased 2021 dependent-care FSA limits to 10500 from 5000 offering a higher tax break on top of existing rules allowing more time to spend the money. Dependent Care FSAs DC-FSAs also called Dependent Care Assistance Plans DCAPs 2022. The 2022 HSA contribution limit for individual coverage will increase by.

If both you and your spouse participate in a dependent care FSA the total. For 2022 participants may contribute up to an annual maximum of 2850 for a HCFSA or LEX HCFSA. Thanks to the American Rescue Plan Act single and joint filers could contribute up to 10500 into a dependent care FSA in 2021 and married couples filing separately could.

For 2022 it remains 5000 a year for individuals or married couples filing jointly or 2500 for a married person filing separately. Unlike the health care FSA which is indexed to cost-of-living adjustments the dependent care FSA maximum is set by statute. Unused amounts from 2020 are added to the.

The annual contribution limit for 2022 does not apply. Maximum salary deferral single taxpayers and married couples. Dependent Care FSA Contribution Limits for 2022.

The maximum amount you can put into your Dependent Care FSA for 2022 is 5000 for individuals or married couples filing jointly or 2500 for a married person filing. The extra 200 can. The IRS sets dependent care FSA contribution limits for each year.

The 2022 healthcare FSA contribution limit is an increase of 100 from the 2021 healthcare FSA contribution limit 2750 and the carryover limit is an increase of 20 from the 2021. As set by the internal revenue code the dependent care fsa limits for 2022. For example suppose in 2021 you did not spend 1500 in your FSA.

Dependent Care Fsa Limit 2022 Income Limit.

Irs Announced A Slew Of Inflation Adjustments For 2023

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

:max_bytes(150000):strip_icc()/dotdash-hsa-vs-fsa-v3-66871b956baa4be786d2138777e70067.jpg)

Health Savings Vs Flexible Spending Account What S The Difference

Irs Announces Health Fsa Limits For 2022 M3 Insurance

Dependent Care Fsa Payment Options To Get Reimbursed Wageworks

Dependent Care Fsa Vs Dependent Care Tax Credit Smartasset

Understanding The Year End Spending Rules For Your Health Account

Flexible Spending Accounts Fsa Isolved Benefit Services

F S A Limits In 2022 You May Be Able To Carry Over More Money The New York Times

2022 Retirement Plan Contribution Limits

Covid Relief Fsa Rules Provide Longer Periods To Spend Unused Balances Montgomery County Public Schools

New 2022 Brochure For Dependent Care Assistance Plan Fsa Benefit Plan Document Core Documents

Using A Dependent Care Fsa To Reimburse Childcare Costs In 2022

Health Care Fsa Contribution Limits Change For 2022

Fsa Hsa Contribution Limits For 2022

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning